A “catch-all” provision of the Amended Measures is amended to capture all other institutions (be they financial institutions or otherwise) which engage in financial business and which are determined by PBOC to be performing anti-money laundering obligations.

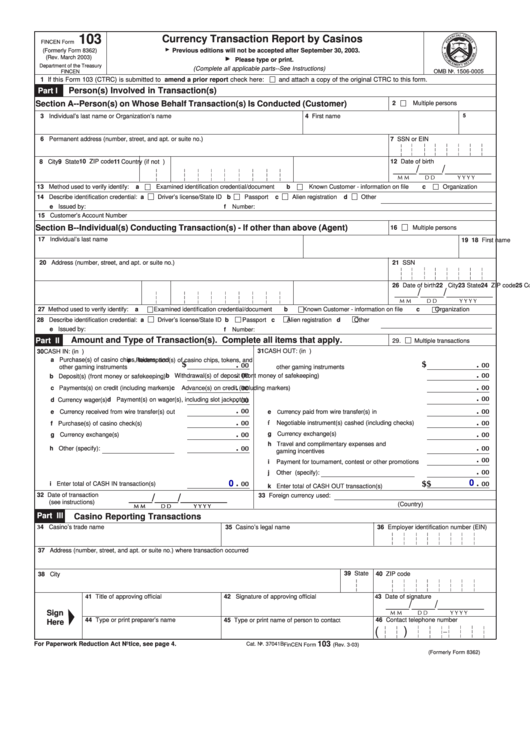

#Currency transaction report amount professional

The Amended Measures expressly identify a few additional financial institutions and make them subject to the requirements of the Amended Measure, including insurance professional agents, insurance brokerage companies, consumer finance companies and loan companies. The Reporting Obligations under the Current Measures apply to major financial institutions regulated by financial regulators in China and institutions conducting specific businesses, such as payment or clearing business. We summarize these major changes introduce by the Amended Measures as follows: A wider scope of application This is in line with the overall trend of regulatory reform of China in recent years which gives regulated entities more autonomy in conducting businesses while increasing the risks of noncompliance. Under the Amended Measures, financial institutions will not only need to comply with requirements explicitly set out therein, but also formulate their own transaction monitoring standards for suspicious transactions and ensure the effectiveness of such standards in preventing money laundering.

The Amended Measures revise the Current Measures substantially and impose greater obligations on financial institutions in the reporting of large-sum and suspicious transactions ( Reporting Obligations).

On December 28, 2016, the People’s Bank of China ( PBOC) issued the amended Administrative Measures on Reporting of Large-Sum Transactions and Suspicious Transactions by Financial Institutions (the Amended Measures), which will take effect on Jto supersede the current administrative measures having been in effect since March 1, 2007 (the Current Measures).

0 kommentar(er)

0 kommentar(er)